Content

- Direct method vs. indirect method of cash flow

- What is the indirect method of cash flow?

- Why do we add back Depreciation and amortization Expenses?

- How to Prepare a Statement of Cash Flows Using the Indirect Method

- What Is the Difference Between Accounting Profit & Taxable Income?

- The Disadvantages of Direct Write-off Method

Postponing liability payments is a common method for saving cash and keeping the reported balance high. An increase in any prepaid expense shows that more of the asset was acquired during the year than was consumed. This additional purchase requires the use of cash; thus, the balance is lowered.

- Similarly, the $142 increase in the prepaid expenses balance is also deducted from net income.

- The indirect method assumes everything recorded as a revenue was a cash receipt and everything recorded as an expense was a cash payment.

- For smaller businesses, you may not have any of the investment activities discussed previously.

- This reading explains how cash flow activities are reflected in a company’s cash flow statement.

- There is no specific guidance on which profit amount should be used in the reconciliation.

Thus, the $19,000 should be subtracted in arriving at the cash flow amount generated by operating activities. The cash received was actually less than the figure reported for sales indirect method cash flow within net income. In this example, no cash had been received but $500 in revenue had been recognized. Therefore, net income was overstated by this amount on a cash basis.

Direct method vs. indirect method of cash flow

The cash would be reported in the investing section as proceeds from the sale of a long term asset. The difference between the book value of $60 and the cash received $150 is the gain of $90 which was reported on the income statement but is not a cash item. There are two methods of converting the income statement from an accrual basis to a cash basis. Companies can use either the direct or the indirect method for reporting their operating cash flow. Significant non‐cash items on the income statement include depreciation and amortization expense and gains and losses from the sales of assets or retirement of debt.

- Companies can use either the direct or the indirect method for reporting their operating cash flow.

- Both the direct and indirect cash flow methods tell the same story about how cash moves through your business but do so from a different starting perspective.

- Thus, when accounts receivable increases, sales revenue on a cash basis decreases .

- Learn the best method for creating this important statement.I am not a big fan of pumpkins or espresso.

- Two approaches to developing the common-size statements are the total cash inflows/total cash outflows method and the percentage of net revenues method.

That’s why most businesses use theindirect method.Because the information they need to create reports is readily available in the general ledger. The cash flow statementreports on the movement of cashfrom all sources into and out of the business.

What is the indirect method of cash flow?

Thus, when accounts receivable increases, sales revenue on a cash basis decreases . When inventory increases, cost of goods sold on a cash basis increases . When a prepaid expense increases, the related operating expense on a cash basis increases. (For example, a company not only paid for insurance expense but also paid cash to increase prepaid insurance.) The effect on cash flows is just the opposite for decreases in these other current assets. Add back losses and subtract gains from investing or financing activities.

While it takes longer to compile, the direct method gives a more transparent view of your cash inflows and outflows. On the other side of the coin, we have theindirect cash flowmethod. Although both cash flow reporting methods meet Generally Accepted Accounting Practices and International Financial Reporting Standards , theguidelines encourage the direct method. While one form of cash flow reporting is more common,both methods have advantages. Even as an accountant, I recognize many of the traditional account reports can seem superfluous. The popular saying that cash is king is popular for a reason, and there’s no better report to learn about how you are using and conserving cash. At the end of the graphic there is a final reconciliation of the cash account.

Why do we add back Depreciation and amortization Expenses?

Next, net income is adjusted for the changes in most current asset, current liability, and income tax accounts on the balance sheet. The accounts receivable balance decreased $663 from $19,230 to $18,567. As cash is increased when cash is collected from customers, a decrease in the accounts receivable balance represents an increase in cash. If the accounts receivable balance increases, the amount of the increase is subtracted from net income, the opposite of what happens when the balance decreases. As inventory is purchased, cash is assumed to be paid, so the $107 increase in the inventory balance is subtracted from net income . Similarly, the $142 increase in the prepaid expenses balance is also deducted from net income.

How do you calculate total inflow?

(1) Total expected cash inflow over a period is calculated by, for each contractual cash inflow over the period, multiplying it by the applicable inflow rate (giving the adjusted inflow), and then taking the total of all the adjusted inflows over the period.

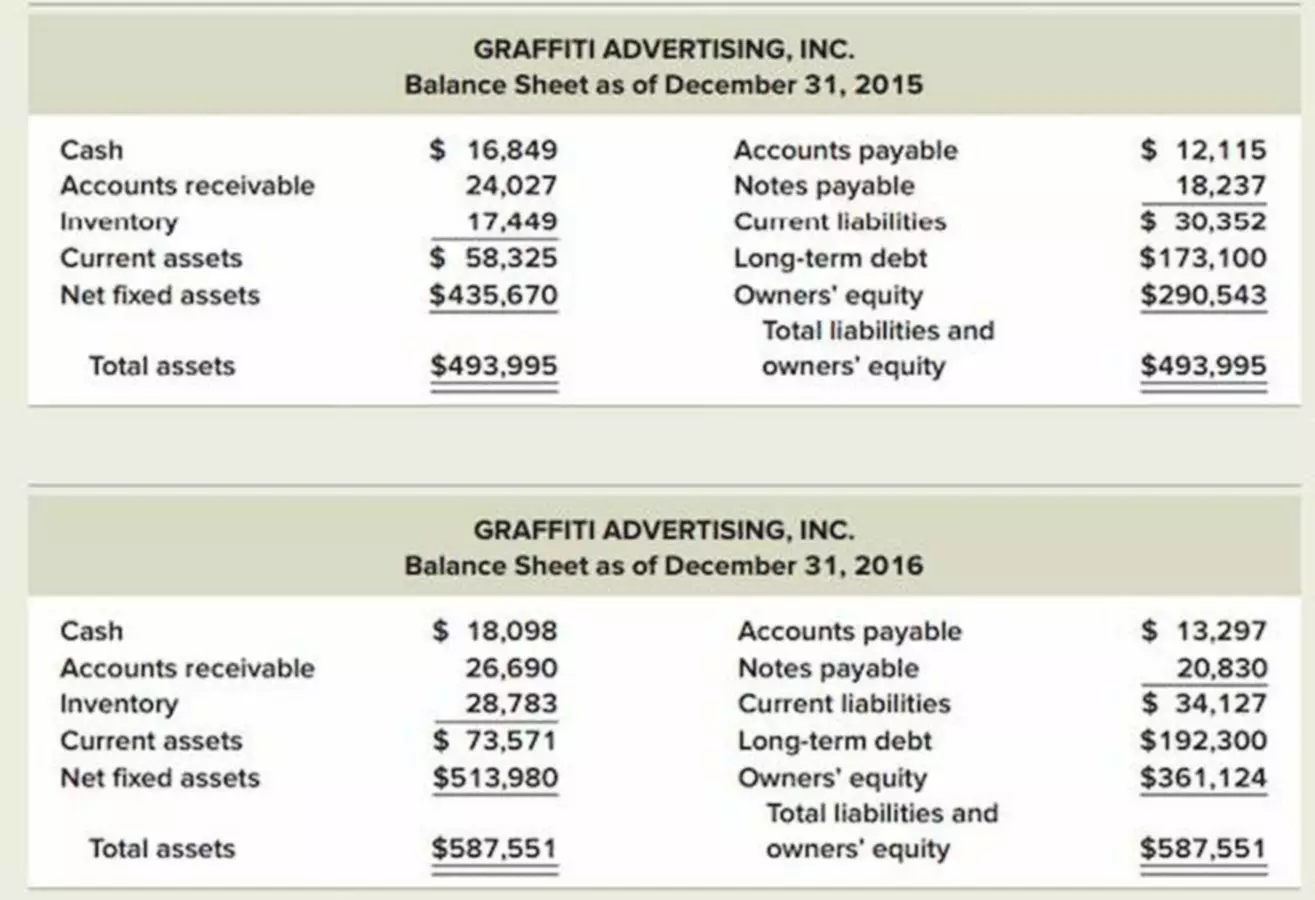

Along with your income statement and balance sheet, a cash flow statement can give you a better picture of your business’s financial health, including your profitability and spending habits. The cash flow statement is linked to a company’s income statement and comparative balance sheets and to data on those statements. Both the direct and indirect cash flow methods tell the same story about how cash moves through your business but do so from a different starting perspective. The income statement and balance sheet have their own purposes, but the cash flow statement will give you the full picture on how cash, the most important account, is flowing through your business. Those cash transactions are reflected in applying the indirect method by a $5,000 subtraction. Any jump in a liability means that Liberto paid less cash during the period than the debts that were incurred.

How to prepare a statement of cash flows using the indirect method

The operating activities section is the only difference between the direct and indirect methods. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. This is not only difficult to create; it also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate. Under IFRS, there are two allowable ways of presenting interest expense in the cash flow statement.

Having said that, the Financial Accounting Standards Board favours the direct method, as it provides a clearer picture of the cash flows moving in and out of your business. With the direct method of cash flow, you count only the money that actually leaves or enters your business during the designated reporting period. To do that, you start with a blank slate, then add and subtract all your company’s operational cash transactions. These transactions https://www.bookstime.com/ could include receipts from product or service sales, payroll, rent, supplier payments, or materials expenses. Certain cash transactions from operating activities are not revenue related and thus, not included in net income. For example, companies receive cash when customers prepay for future delivery of goods or services, but do not record the payments as revenue. Instead, companies record customer prepayments as unearned revenue under liability.

The impact is the same in the indirect method as in the direct method. Take your accrual net income plus depreciation and subtract your change in accounts receivable, change in inventory, and change in accounts payable. Then add any noncash expenses and subtract any customer deposits. In the indirect method, the accounting line items such as net income, depreciation, etc. are used to arrive at cash flow. In financial modeling, the cash flow statement is always produced via the indirect method.

It’s faster and better aligned with the way this accounting method works. Accountants overwhelmingly prefer it for reporting cash movement. IAS 7 was reissued in December 1992, retitled in September 2007, and is operative for financial statements covering periods beginning on or after 1 January 1994. Accounts Payable in the balance sheet represent bills and invoices that the company has not yet paid – but have still recorded as an expense in the Income Statement. If an asset account decreases, cash must have come in exchange for the Asset decrease. The opposite is true if you see a decrease in accounts receivable.